thabThaA loan refers to the funds that a borrower can avail from banks or any other financial institutions to meet their uncertain cash requirements and, in return, promises to pay back the principal amount and the interest after a certain period of time. To safeguard yourself from paying back huge amounts, you must timely repay the amount borrowed. Loan repayment refers to timely paying back the borrowed amount to the lenders. The repayment of the amount occurs through a series of scheduled payments, including the principal amount and the interest payment. There are several benefits associated with timely loan repayment.

Benefits of Personal Loan Repayment

Keep scrolling to know the advantages of paying back EMIs on time.

- You can save yourself from the penalties and late fees by paying back the personal loan amount on time.

- However, high penalties will put you in a worse financial position.

- Timely instant personal loan EMI payment helps to maintain your high credit score and good credit history.

- Timely payment ensures that you are a creditworthy borrower.

- If you easily and timely pay back the personal loan EMI’s, then it becomes easy for you to avail an instant loan easily in future.

Importance of Loan Repayment

Timely loan repayment is important as it not only reduces your loan liability and interest accrued but is also reflected in your credit history. The immediate financial consequences of late repayment can range from higher interest rates charged on loan amounts to cases being filed against the borrower.

How Does Loan Repayment Impact your Credit History?

When the loan repayment treats as carelessly, then it can negatively affect your financial stability. The delay in repayment will directly affect your credit score. Your credit history will reflect your carelessness, and thus the lender will not offer you an instant loan. The lender can opt to deny your loan application or charge a higher interest rate due to the perceived risk of recovering the loan amount on time. The higher the number of defaults or late payments, the more likely it is that you will have a poor credit score. This is because unpaid debts signify that you can’t manage the credit that you have taken on.

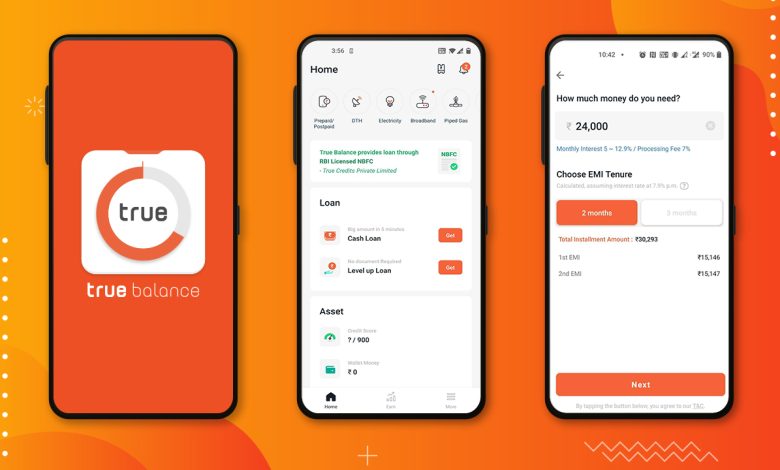

If you want to build up a solid credit history and credit score, try paying back the loan amount as specified while availing the loan. Hence, availing an instant personal loan from the TrueBalance online loan app is like a cakewalk. If you are an Indian resident, you can easily apply for a personal loan of an amount up to INR 50,000 without any collateral backup in return. To avail an instant loan, all you need to do is download the TrueBalance online loan app from Google Play Store, fill in the basic details, upload the required documents and there you go.

You can easily apply for a loan from this loan app. No matter, what’s the time, or what is the emergency, you can avail an instant personal loan easily from the TrueBalance Personal Loan app as the services are 24*7 hours available. I rely on this financial lending application to cover my uncertain expenses. For more details, download the TrueBalance Loan app or visit their website!