What are the Good and Bad sides of Digital Lending?

Digital lending refers to the entire loan availing process that is carried out through mobile apps. In the past few years, an enormously high demand for digital lending apps have been witnessed because of the following reasons:

- A borrower-friendly approach

- Easy to avail

- Hassle-free

- Minimum documentation required

- 100% online and many more.

You can use the digital lending platform to plug the gaps during a sudden monetary shortfall or use the funds to boost your finances. The personal loan can be used for any purpose as it has high-end use.

Availing a personal loan has become extremely easy with the introduction of online loan apps. Just a decade ago, the borrowers were expected to follow a long, hectic process to get the loan request approved. But, now, with the introduction of the loan apps, all these hassles have come to an end.

Various digital lending apps have been introduced that offer an instant personal loan to the borrower. But, not all of them are reliable. Data privacy issues and unethical or illegitimate lending operations pose a higher risk to the borrower’s financial stability. Before applying for a loan from any particular app, the borrower must check whether the NBFC is registered with RBI or not, and they must also check the eligibility criteria. There are both good and bad sides associated with digital lending. Keep scrolling to know the details:

Good Side of Digital Lending

Fast and Hassle-Free Process

To avail of an instant personal loan from the online loan apps, the borrower must submit the minimum documents online. It just takes a few minutes to apply for an online loan and to get the loan request approved. With the online lending platforms, you no longer have to wait in long lines for long hours or travel personally to the bank to apply for a loan. This helps to save you both time and energy. Therefore, the loan availing process from online loan apps is fast and hassle-free.

Quick and Easy Approval

Compared to applying for a loan from any other source, it is easy to get your loan request approved from online lending platforms. This is because online lenders have low criteria that the borrowers can easily meet. To avail of an instant loan from the loan apps, you must have a stable source of income, a bank account, and meet the eligibility criteria specified by different lenders.

Can Compare Multiple Loan Offers

The best part of an online loan application is that you can easily find the reviews and compare different loan apps to get an overview of each lender’s interest rates, terms and conditions, fees, and other benefits or drawbacks. Also, you can apply for preapproval or prequalification with a lender to get an estimate of the loan amount, rates, and terms you’ll receive.

Bad Side of Digital Lending

Legal Tangle

The RBI panel found that more than 50% of loan apps are illegal. With the rising demand for online loan apps, various scammers have found it an opportunity to take advantage of people’s uncertain times. Hidden charges, high-interest rates, misusing the borrower’s personal data, and many more acts are being performed by the scammers.

Repayment Challenges

The rising number of bad loans is a big worry for online lenders. Since personal loans are unsecured loans, the borrowers even try to take advantage of the lender by not paying the loan amount on time or not paying the amount at all. Moreover, since the loan is provided without pledging any of their assets, they usually default in paying back the amount. According to the RBI panel, responsible lending will remain a “distant goal” without customer awareness and watchful enforcement.

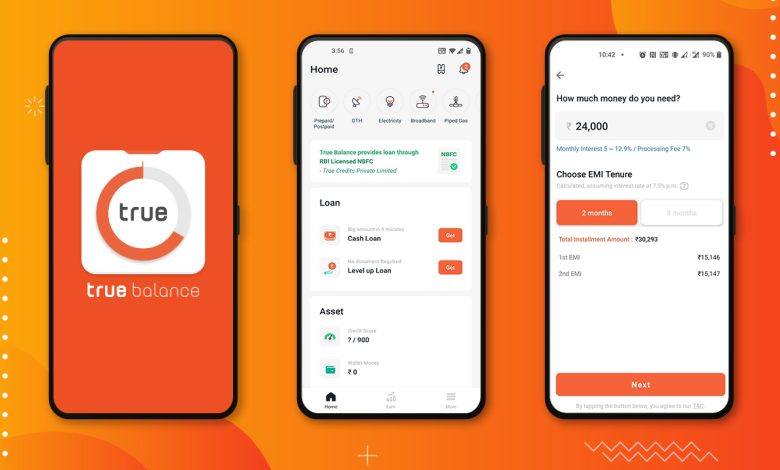

For a personal loan online, you must always rely on those lending apps that are registered with RBI and offer loans at easy terms and conditions and low-interest rates. Loan apps like TrueBalance fulfill these criteria. It is a mobile financial lending platform that is available for android users only. Want to avail of the hassle-free loan? Download TrueBalance. Want to avail of an instant loan? Want to apply through a reliable loan app? Download TrueBalance. TrueBalance is the solution for any financial hassle!