Support and Resistance Basics

At firstglance, the explanation and the concept behind these levels may seem simple however, as you’ll learn that support and resistance take on different ways and the concept can be more complicated than initially appears.

KEY TAKEAWAYS

- Technical analysts employ levels of support and resistance. To determine prices on a chart that indicate odds favor a pause, or a change in a dominant trend.

- Support is when the downtrend is likely to stop due to a heightened of demand.

- The term “resistance” refers to the situation when an uptrend may slow down for a short period, as a result of the concentration of supply.

- Market psychology plays an important part in how traders and investors are able to recall the past and respond to changes in the market to anticipate market movements in the future.

Support and Resistance Defined

Support is a level at which the downtrend is likely to slow down due to a high. Concentration of demand or purchasing interest. As the cost of securities or assets declines and shares are sold, the demand grows, which forms the line of support. In the meantime, support resistance indicator zones form due to the selling of interest after prices have risen.

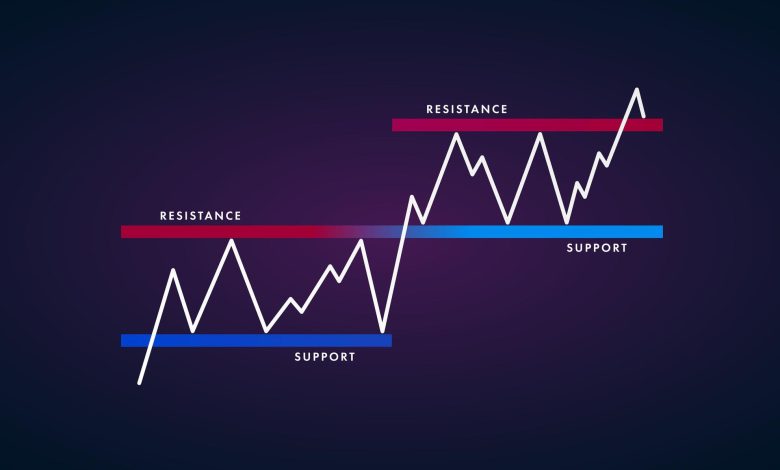

That when a price reaches an area of resistance or support. It can do one of two things: bounce away from the resistance or support threshold. Or breach this price range and continue to move in its direction. Until it reaches the next resistance or support level.

If the price does move in the right direction it could be significant.

The Basics

Many experienced traders can tell stories of how certain levels of price. Tend to deter trader from pushing value of the underlying asset in a particular direction. Consider, for instance, that Jim held an investment in stocks from March to November. He also knew that he expected the value of his shares to rise.

Let’s say that Jim observes that the price is unable to reach $39 more than a few times. In the course of a few months even though. In this instance traders would consider the price at $39 to be a mark of resistance. It is evident in the graph below as well, resistance levels can also be thought of as a level that is a ceiling, since they represent the areas in which a rally is running out of fuel.

The levels of support are the reverse face of the coin. Support levels refer to the prices on an chart that act as a floor , preventing the value for an investment from being driven downwards. You can observe on the graph below it is possible to determine an area of support may also be associated with a potential buying opportunity since it is the region that market participants perceive potential value and begin pushing prices up and higher.

Trendlines

The above examples show how that a constant level can stop the price. Of an asset from shifting upwards or downwards. This is among the most well-known kinds of support/resistance. However, the value of financial assets tends to move either upwards or downwards. So it’s not unusual to observe these price barriers shift in time. This is the reason the notions about trending as well as trendlines can be essential in understanding the relationship between support and resistance.

If prices are moving towards the upwards and resistance levels begin to form. When the price movement slows and moves back towards that line of trend. This happens because of profit-taking, or uncertainty about the future in a specific sector or issue. The resultant price movement is the “plateau” effect and a slight decrease in the price of stocks, resulting in the appearance of a temporary peak.

A lot of traders pay keen at the value of a security. When it moves towards the larger base of the trendline as in the past. This has been a region which has prevented the value of the security from falling significantly lower. For instance as you can see in below the Newmont Mining Corp ( NEM) chart below, a trendline may help an asset over a period of time. In this instance, note the way the trendline supported the value of Newmont’s shares over long periods of time.

However in the event that saxo capital markets review are trending towards the downside. Traders look for a string of decreasing peaks and try to link these peaks to the trendline. If the price is close to the trendline, traders will be watching for the possibility of selling pressure and will think about entering into a short position due to this being an area where it has been pushed prices down previously.

The more instances that the price has not been able to break through it. Many traders using technical indicators will utilize their own identified levels of support and resistance to select the most profitable entry and exit locations, as these levels typically reflect the prices which are most significant in determining the direction of an asset’s. Many traders are confident in these levels with respect to the base price of their asset which means the volume tends to rise higher than normal and makes it harder for them to keep pushing the price up or lower.

Real trading and investing are emotionally and make mistakes in their thinking and resort to the heuristics or shortcuts. If they were rational their resistance and support levels wouldn’t be effective in real life!

Round Numbers

Another characteristic common to resistance and support is that the price of an asset might have difficulty. Getting past a number that is round that is, for example, $150 or $100 for a share. The majority of novice traders prefer to purchase or sell assets when the price is the whole amount because they tend to believe that the stock is valued at these price levels. The majority of price targets (also known as stop orders) formulated by large or retail investors banks are set at the round price level instead of at prices such as $50.06. Since so many orders are put in at the same price and at the same time, these numbers can be said to serve as powerful price barriers. If all clients of an investment institution put on sell orders at the suggested price of, say, $55, it would require an enormous amount of purchases to take in these sales and, consequently the level of resistance could be established.