Should You Use a Personal Loan for Home Renovation

Purchasing your dream home and maintaining it on a daily basis might be costly. If your property requires extensive renovations, a personal loan for the home renovation can assist you in covering the costs. Fortunately, some non-bank financial institutions (NBFIs) are providing loans to customers who need money to refurbish their homes. You may be eligible for a personal loan for home remodeling if you require funds to finance necessary repairs and renovations in your home.

Personal loan for home renovation

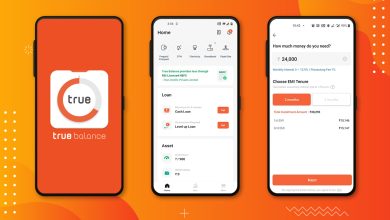

A personal loan is an unsecured loan that can be used for whichever purpose you like. It is a multipurpose loan that can be used for any purpose with no restrictions. No bank official will interrogate you about how you spent the money. If the renovations you want to make to your home are out of your budget, you can finance them with a personal loan designed for the purpose. There is no risk to the borrower because no collateral is required, and the lender approves it based on the applicant’s eligibility, income, and credit score.

When you utilize this loan to finance your home renovation, there are no constraints on the end use. You have complete freedom to renovate your home, including bathroom and kitchen renovations, and any other modification that is appropriate for your home.

Features

Flexible tenure

The term of an instant personal loan normally ranges from one to five years, and you can return the amount whenever you choose.

High loan amount

For the purpose of home renovation, you can get a personal loan of up to INR 25 lakhs.

Quick approval and disbursal

Your documents will be validated when you apply for the loan, and you will receive an approval within minutes. The money will be transferred to your account as soon as the loan is approved.

Minimal eligibility criteria

To qualify for a personal loan, you must meet certain eligibility requirements. It’s an excellent choice for home renovation because of the simple online application process and minimum documentation requirements. Let’s have a look at the personal loan eligibility criteria for home renovation:

- You must be at least 21 years of age.

- The applicant must be an Indian citizen

- You should work for a multinational corporation, a private company, or a public limited company.

When should you use a personal loan for home renovation?

Many banks provide promotional Personal Loans, such as 0% APR for the first six months. These kinds of loans may appear to be cost-effective, but make sure you can make all of your payments in full and on time, every time, or the higher interest rates may eat into your budget. Before agreeing on a loan, check about the greatest deals in town, just as you would with any other financial product. There are comparison services, which can show you tailored offers from multiple lenders that you qualify for based on your needs and preferences, allowing you to choose the best option for you.

Conclusion

When compared to a home renovation loan, a personal loan offers greater benefits. It allows you the freedom to turn your home into the home of your dreams with the finances you borrow. The sole disadvantage of taking out a personal loan is the higher interest rate, which can be avoided if you have a decent credit score.