Understanding Systematic Investment Plans (SIPs) and their benefits

Looking to invest in mutual funds but unsure how to get started? You’re not alone – many people find it challenging to take the first step.

With markets being unpredictable, knowing when and where to invest can feel overwhelming. That’s why having a structured, disciplined approach is essential.

A strategy that eliminates the need for constant market tracking or perfect timing could be the solution you need. This is exactly where a Systematic Investment Plan (SIP) comes in.

What is an SIP and how does it work?

An SIP offers a systematic approach to investing in mutual funds. By setting up an SIP, you commit to investing a specific amount, which could be as low as ₹500, at regular intervals (e.g., monthly, quarterly, or semi-annually) into a chosen mutual fund scheme.

The number of units you will receive depends on the prevailing Net Asset Value (NAV).

To estimate your future returns from these investments, you can use an SIP calculator available online. You only have to enter details like the monthly investment amount, expected rate of return, and investment duration.

Once the tool calculates the future value of your SIP, you can modify your investment strategy accordingly.

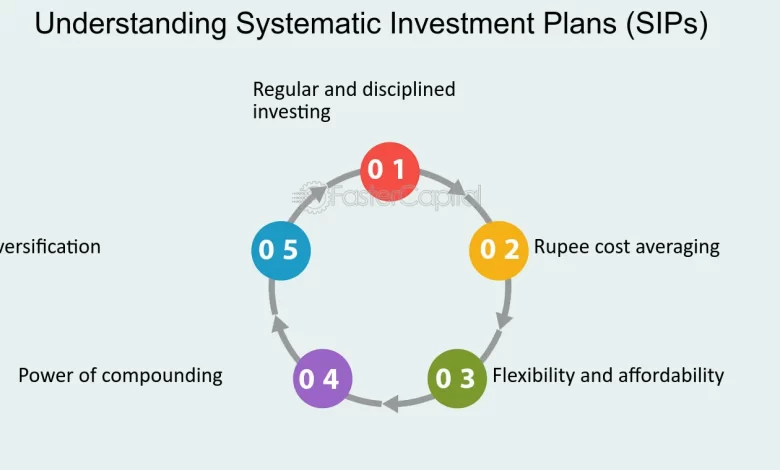

Benefits of SIPs

An SIP benefits investors in multiple ways, including:

Rupee-cost averaging

Since the market is unpredictable, trying to time investments to buy at the lowest and sell at the highest point can not only be stressful but nearly impossible to do consistently. This is where an SIP helps.

When markets are high, your fixed investment buys fewer mutual fund units since each unit is priced higher. When markets are low, you buy more units because the price per unit is lower.

This strategy helps you balance out the cost of investment and optimise long-term returns by investing through both market ups and downs.

Compounding benefits

The power of compounding is one of the most useful features for long-term wealth creation.

Compounding works by generating returns not only on your initial investment but also on the returns you have accumulated over time.

In an SIP, as you invest regularly, your money starts to grow exponentially because each period’s earnings are reinvested and generate further returns.

Note that the sooner you invest in mutual funds and the longer you let your money grow, the more powerful compounding becomes in boosting your wealth.

Multiple types of SIPs for different goals

You can invest in different types of SIPs, including:

- Regular SIP: This is the most common type, where you invest a fixed amount at regular intervals (weekly, monthly, quarterly, half-yearly, or annually).

- Top-up SIP: Allows you to increase your SIP amount at predefined intervals.

- Flexible SIP: Offers the option to adjust your investment amount based on your financial situation and cash flow needs.

- Perpetual SIP: Lets you continue investing without a predefined end date.

- Trigger SIP: A trigger SIP allows you to automatically redeem part or all your investment or switch to another scheme when a predefined trigger point is reached.

Disciplined investment routine

A disciplined investment routine is important for building long-term wealth, and SIPs are the perfect vehicle to develop this habit. By automating the investment process, SIPs allow you to make regular contributions toward your chosen mutual fund.

This method can help you prioritise saving and investing as part of your budget. Most importantly, you are able to avoid bad market timing, control emotional investing, and stay committed to long-term goals.

Invest in SIPs online today!

SIPs simplify the process of investing in mutual funds. They provide an efficient, disciplined, and affordable way of entering the financial markets.

Their benefits, such as rupee-cost averaging, compounding returns, and market volatility reduction, make them an ideal option for investors looking to build wealth over the long term.

Whether you are saving for retirement, your child’s education, or a major purchase, SIPs can be customised to meet different financial goals.

Just remember the three golden rules: start early, invest regularly, and stay invested for the long term to optimise returns.